Amazon loses $450,000,000 in value in just over a week after they release statement on latest earnings

It's their biggest losing streak in nearly 20 years

Featured Image Credit: hapabapa / Getty

We know that money makes the world go round, and while we're repeatedly told it doesn't make you happy, most of us still wouldn't mind having a bit more.

Even for Elon Musk, boasting a $844 billion net worth, we imagine he still worries about money.

It's the same for companies, with the big giants of the tech world constantly seeing their bottom line fluctuate. In all of history, only four companies have ever crossed a $4 trillion market cap, while only Nvidia has ever leaped over the $5 trillion mark.

Despite being one of the big kahuna's, Amazon has failed to get past $3 trillion, previously crossing the $2 trillion line in June 2024. It doesn't look like Jeff Bezos' internet marketplace will be getting there anytime soon, with Amazon just wiping $450 billion of its market cap.

Advert

Given that Bezos is currently worth $216.2 billion, that's two whole Bezoses lost in a matter of days.

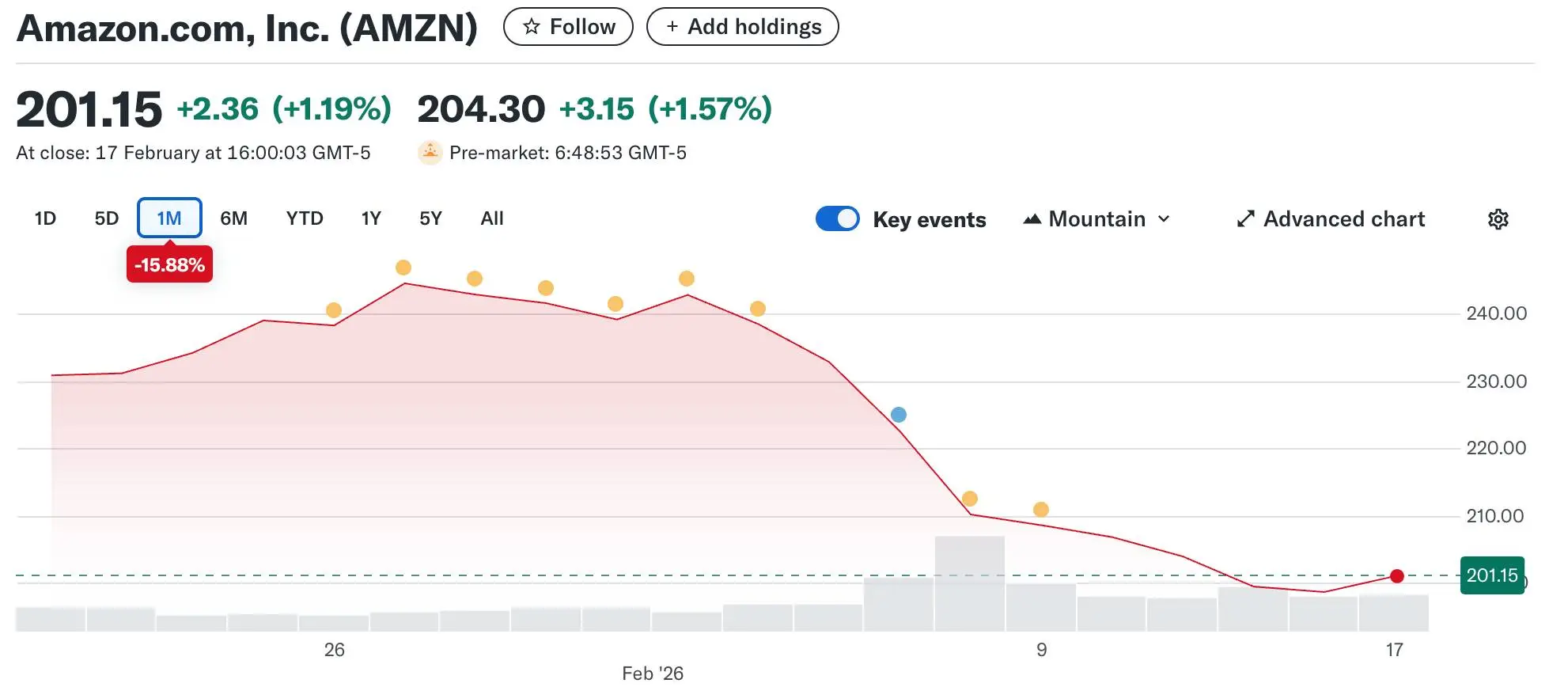

As reported by CNBC, Amazon has just snapped out of an unfortunate losing streak, with markets closing up 1% on February 17. This celebrates the end of an 18% value drop between February 2 and February 13, marking the company's worst run since 2006 and taking that $450 billion chunk off its market value.

The outlet notes that this comes in the aftermath of Amazon revealing its plans for artificial intelligence, announcing that it plans to spend around $200 billon in capital expenditures in 2026. That's up 60% from 2025 and puts it $50 billion above Wall Street's forecast.

With concerns about what AI is doing to productivity and potentially replacing humans, there's been further backlash over Amazon confirming some of this increased spend will be down to AI-related initiatives that require the likes of data centers and chips.

There are continued complaints that the price of game consoles is going up due to AI pushing the price of RAM through the roof, while Amazon has already seen angry employees sign an 'explosive' letter calling out its AI usage.

Defending this AI evolution, Amazon CEO Andy Jassy told analysts it will “yield strong returns on invested capital." Similarly, Amazon Web Services CEO Matt Garman told CNBC how the company will be able to 'seize' AI opportunities involving the cloud during a recent interview.

Wedbush analysts reiterated that Amazon is currently in a "prove it mode" after revealing its fourth-quarter report, outlining: "The increase in spending will remain an overhang as investors digest the guide and will likely need to see more tangible returns before regaining comfort."

Andrew Boone, Citizens managing director and research analyst, told CNBC that Jassey's comments on Amazon doubling data center capacity across the rest of 2026 are an 'underappreciated' growth driver: "We think that’s going to lead to an acceleration in terms of AWS revenue as more capacity comes online."

While Amazon seems to be out of its slump for now, the ever-fickle stock market continues to show how quickly things can change.