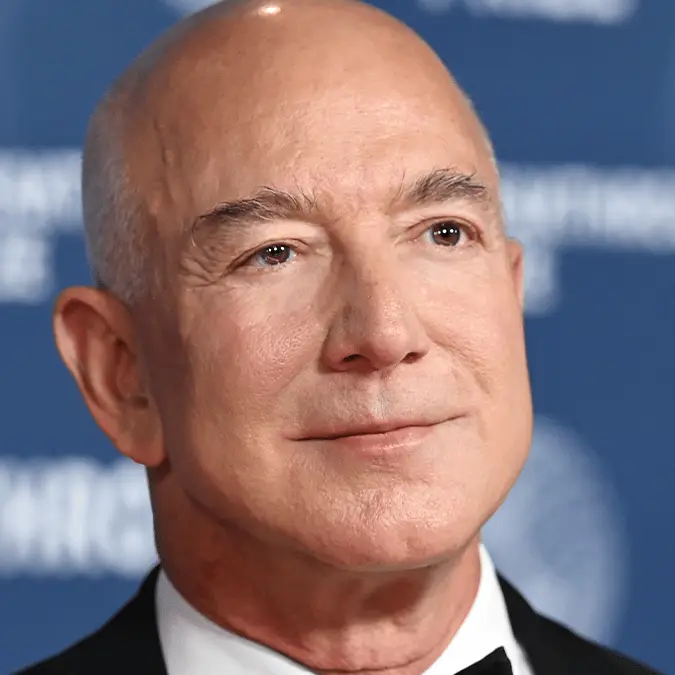

Jeff Bezos, the billionaire founder of Amazon, is set to sell off an eye-watering $4.8 billion worth of Amazon stock over the next year, and the timing couldn’t be more telling.

While the tech giant is riding high with a 9% year-over-year net sales increase and a $3.1 billion bump in operating income, Bezos’ massive sell-off reveals an even bigger story.

The move comes after Bezos adopted a 10b5-1 trading plan in March, allowing him to offload up to 25 million Amazon shares through May 2026.

This isn’t the first time Bezos has taken a similar step; just last February, he sold off $8.5 billion in Amazon stock.

Advert

As Amazon grapples with the challenges of navigating the complexities of the Donald Trump administration’s tariffs, it’s clear that Bezos may need the liquidity for his own non-Amazon ventures. Beyond Amazon, Bezos has a lot on his plate — from his climate philanthropy work to Blue Origin, his space exploration venture.

But the timing of this stock sell-off also comes at a critical juncture for Amazon, with the company trying to stay afloat amidst tariff battles and potential recession fears.

According to Amazon CEO Andy Jassy: “Obviously, none of us knows exactly where tariffs will settle or when.” The uncertainty around tariffs is real, and it’s putting pressure on tech companies like Amazon to reassess their strategies.

Jassy also added that the company is “maniacally focused” on keeping prices down and stocking up on extra inventory to act as a buffer against the uncertain tariff landscape.

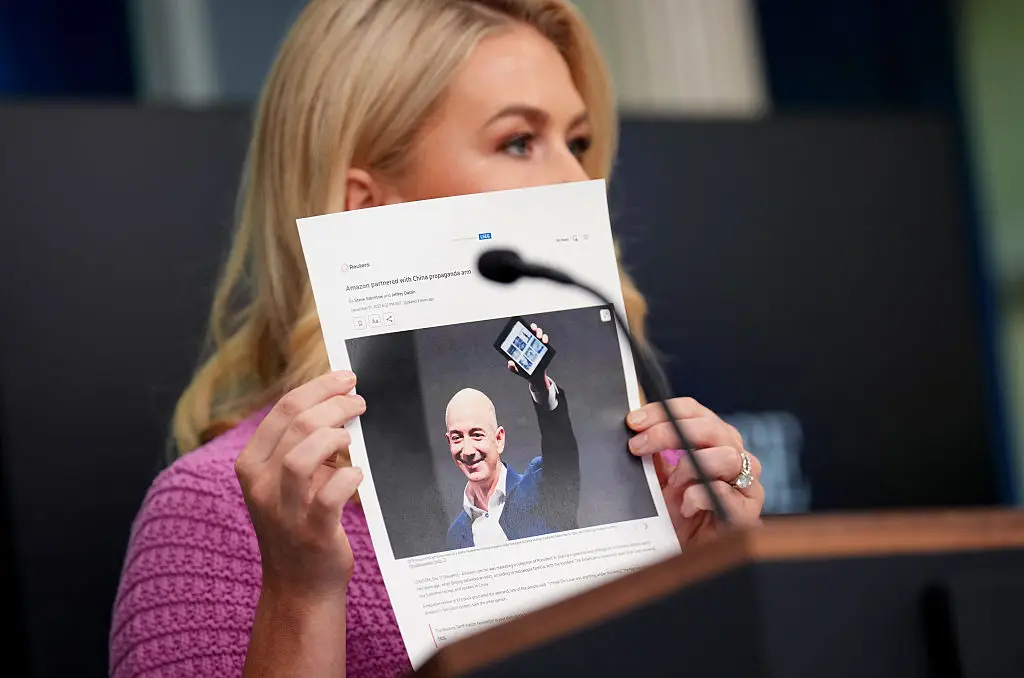

Yet, this strategy has put Amazon — and Bezos — squarely in the crosshairs of the White House. Earlier this week, the Trump administration took aim at Amazon after reports surfaced that the company was considering including information about how tariffs were impacting prices on certain products.

Karoline Leavitt, the White House Press Secretary, was quick to label the move as a “hostile and political act,” questioning why Amazon had not raised such concerns when the Biden administration hiked inflation to its highest level in 40 years.

Despite the political friction, Bezos remains focused on his larger ambitions. The sell-off could help him fund his ambitious climate initiatives and continue his pursuit of space exploration. And while Amazon’s future remains uncertain with the ever-changing political landscape, Bezos is clearly securing his personal financial future.

It’s a bold move for a man who’s made billions in e-commerce, but Bezos is now looking beyond Amazon. Whether it’s for a future of space travel or tackling the climate crisis, Bezos’ next steps might not just shape the tech world, but the world as a whole.