The stock market is a fickle thing, but there's no getting around the fact that it can make someone's fortunes if they're the right combination of lucky and savvy.

If you were an avid day trader back in 2018 you might have spotted some pretty bold predictions made by the CEO of Ark Invest, an investment company that has consistently bet big on Elon Musk's Tesla.

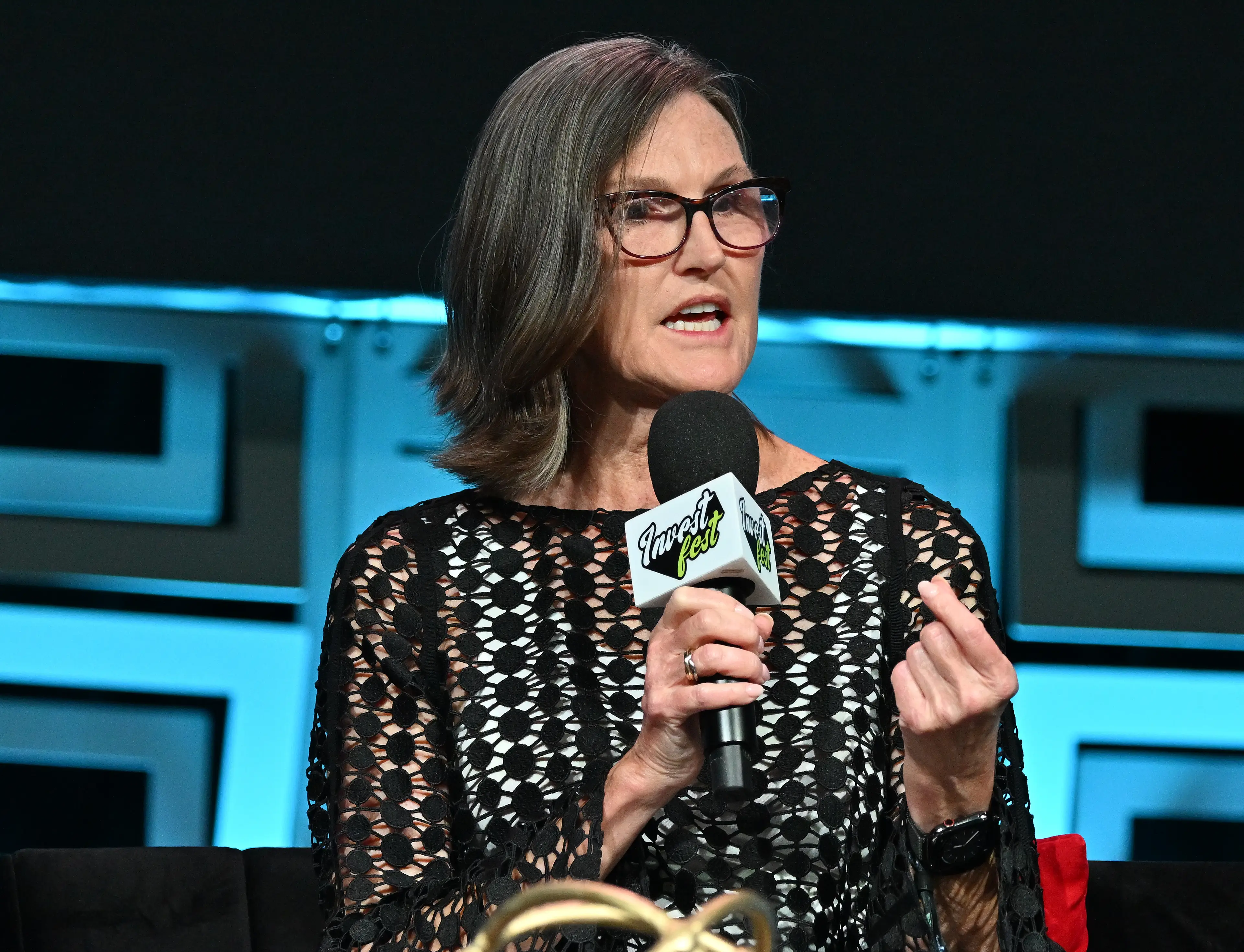

In 2018 its CEO Cathie Wood went on the record to predict that Tesla stock prices would skyrocket from around $350 at the time to hit a high of $4,000 (with her lower bet clocking in at $600).

Advert

Tesla has indeed skyrocketed in the past few years - despite her predictions being way out of line with what more conservative voices were arguing.

Now, Wood is back making another interesting case for Tesla's future, and she's told US financial news site Benzinga all about it.

This time around, with shares currently trading at about $210-220 each, Wood and Ark Invest believe that the price could climb to $2,500 in 2027, and even in their envisioned worst-case scenario they'll still hit $1,400.

If you take that $2,500 price, it means that an investment of $1,000 today could return a whopping $11,625 when that number is reached, a staggering 1,062% increase.

When you start to raise your investment level those numbers quickly get eyewatering, although it should be reiterated that this is pure speculation.

Wood has her reasoning, though, and it's relatively sound - she feels strongly that Tesla is diversifying smartly compared to a half-decade ago.

The launch of the Cybertruck, for example, might see it break into the huge market for trucks in the US and become a bigger player there, shoring up its long-term prospects.

She's even more keen, though, on its work in autonomous driving and taxis, where she sees the potential for Tesla to effectively dominate the market in autotaxis, which don't require human drivers.

That's an interesting argument, and a key part of it for her is that Tesla is building its own AI platform, whereas most other automakers are harnessing others through licensing - this gives Tesla unique power to develop more quickly and nimbly, she told Benzinga.

After all, share prices are partly down to confidence in the given company, and this sort of argument might well help to rally investors to Tesla's cause.

Given Musk's dalliances with controversy in the last 18 months as he's taken over X (formerly known as Twitter), this will presumably be a welcome interjection.