Cryptocurrency's most popular coin has made many people rich over the years, but you could have earned yourself a small fortune if you'd been smart enough to invest your COVID-19 stimulus check into the alternative currency.

Bitcoin has had its ups and downs over the years with the last 12 months in particular being an incredibly profitable period for investors, but many consider it all to have really kicked off during the pandemic years.

It started all the way back in 2010 when one Bitcoin was worth little more than six cents, and it took three years for the cryptocurrency to break the $100 mark. There was a comparatively small spike in 2017 when prices reached just above $19,000-per-coin, but by the start of the current decade things were languishing in at around $8,000.

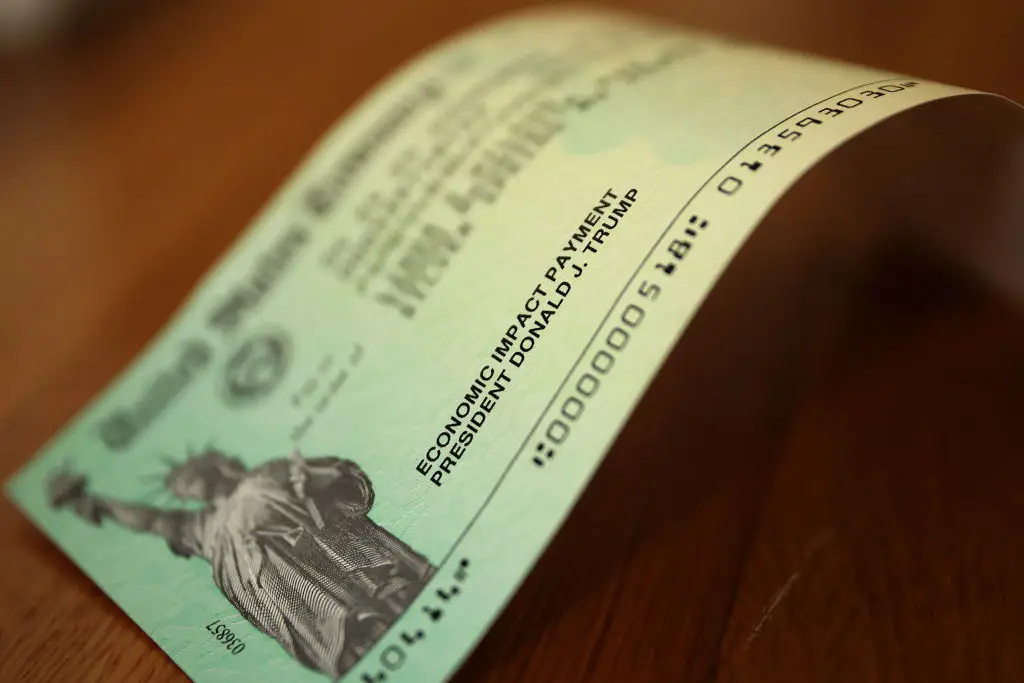

One of the biggest consequences of the COVID-19 pandemic was that millions of people across America were either suddenly out of work or were forced into lower income streams as a result of stay-at-home measures, and the decision was made by the Trump administration to send out a stimulus check worth $1,200 to households affected by the pandemic.

Advert

While there were three separate payments made between March 2020 and March 2021, the most significant was a result of the CARES Act, which gave the aforementioned $1,200 dividend.

Many people understandably had to use this to pay their bills or make up for lost income during the early months of the pandemic, yet some saw it as an extra boost they could use to invest wisely, with many opting for Bitcoin as their route to future fortunes.

When the CARES Act was signed into government on March 27, 2020, the price of a single Bitcoin was at around $6,430.6, so anyone investing the entire stimulus check would be able to receive around 0.187 BTC.

This might not seem like a lot, but if you held onto that exact amount and sold it today, it would be worth roughly $19,685.98, representing an increase of around 1,540 percent.

This is particularly relevant now, not only because Bitcoin is undergoing another major surge, but also after Trump has announced another dividend worth $2,000 for all non-high income Americans, and some experts are predicting that this could prompt some to invest in the crypto coin once again.

David Boylan, CFO at CoinCorner, explains in a statement to UNILAD Tech that "in 2020, the stimulus checks led to an increase in Bitcoin trading volume," adding that "five years later, with greater government and institutional involvement in the sector and increasing retail trust that Bitcoin is here to stay, I would expect the same effect but to a greater extent than we saw in 2020."

If Bitcoin were to increase at the same rate in the next five years it would see the value jump from around $105,356 right now to a jaw-dropping $1,727,838 single-coin value, and your $2,000 would work out to be roughly $32,800 in that same time frame.