Investments are by their nature a financial risk, and you have to be willing to lose sometimes if you're on the hunt for that next big score.

Buying land is a big part of major investments, as it gives you a great amount of freedom - and there's often things that you might not have otherwise expected to find.

While many might go for more 'modern' investment routes, looking towards the stock market or cryptocurrencies like Bitcoin, one keen investor and coal tycoon has managed to strike proverbial gold without even meaning to.

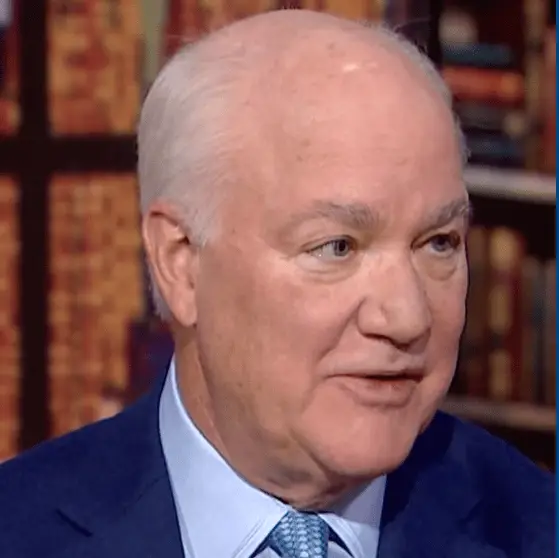

After purchasing Brook Mine in Sheridan, Wyoming, Ramaco Resources CEO Randall Atkins has managed to turn an initial investment of 'just' $2m into a potential $37bn after it's discovered that the land holds rare-Earth materials.

Advert

Initially purchased sight-unseen, it wasn't until years later that Atkins discovered that researchers had tested the land for various rare-Earth materials, testing positive for elements like neodymium, dysprosium, gallium, and germanium.

What remains so vital about these elements is that they're used to construct key technology such as solar cells, semiconductors, and missiles.

It is estimated that just a quarter of Atkins' 16,000 acre plot contains as much as around 1.1 million metric tons of rare-earth oxides, as reported by the Wall Street Journal, and with one of the potential rare-earths selling for more than $1m per metric ton, he could end up making a significant amount more than he initially invested.

It's not only a significant discovery for Atkins, but for the wider United States as a whole, as China controls most of the world's rare-earth refining, and this is the first new mine of its kind in the country since 1952.

While he could end up making far more if every scientific material is fully extracted, the current market evaluation of the mine is around $37 billion, which is around 18,500 times more than Atkins initially paid, and nearly 60 times the value of his company, Ramaco Resources.

It certainly won't be an easy job to get the rare-earth materials out of the mine though, with industry experts estimating that it could cost easily in the hundreds of millions of dollars to get everything up and running.

It's not just a case of money either, as it'll likely be a very long time before anyone is able to benefit from this discovery as the technology and overall process - which Atkins and his team are calling a 'mine to magnets' strategy - will take years to complete.

If everything goes well though it could be a significant breakthrough, and shows that it's worth looking into your investments as you never know if there'll be billions of dollars hiding in plain sight.